How an aerospace engineer applied systems thinking to investing and built the tool he couldn't find.

As an aerospace engineer turned investor, I’ve always approached finance the same way I approach flight dynamics: build systems that withstand turbulence, minimize failure points, and deliver reliable performance.

Early on, I thought "diversification" just meant buying different stocks. But after years of refining my own portfolio, I realized that wasn't enough. True resilience doesn't come from owning 50 different tech stocks; it comes from owning assets that behave differently.

The Flaw in Traditional Portfolios

My journey started with classics like Benjamin Graham's "The Intelligent Investor"(#ad), which taught me the value of safety margins. But as I dug into macro trends by reading Ray Dalio’s "Principles"(#ad) and studying market cycles, I saw the bigger picture.

In 2026, with lingering inflation and geopolitical tension, stock-only portfolios are vulnerable. When the market tanks (like in 2022), most equities sink together. Correlations approach 1.0, and your "diversified" stock basket offers zero protection.

I realized I needed a "Holy Grail" portfolio one balanced across economic regimes:

- Gold for inflation protection and stability.

- Stocks for long-term growth.

- Crypto for asymmetric upside potential.

The 33/33/33 Solution (And the Problem with Tracking It)

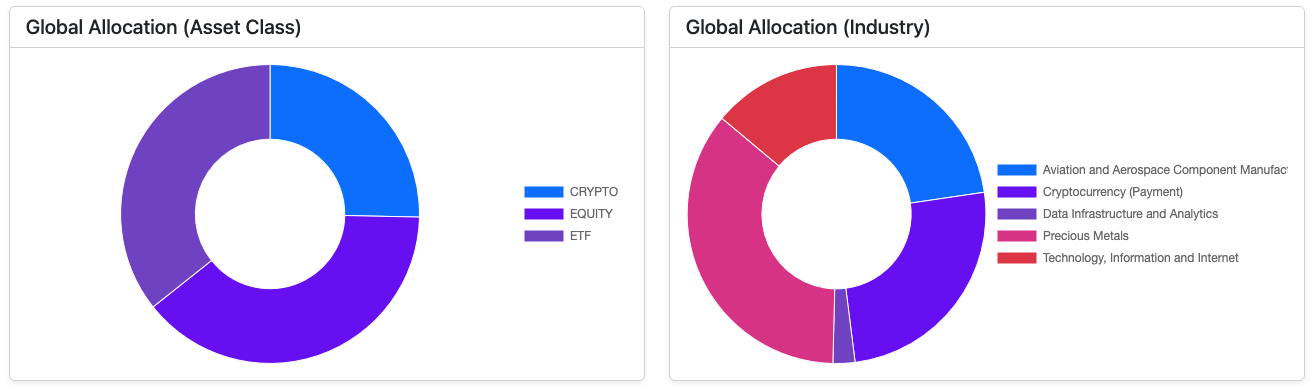

This research led to my personal allocation: roughly one-third physical gold, one-third global equities, and one-third crypto.

It worked. During stock crashes, gold held steady. During bull runs, crypto surged. But managing it was a nightmare. I had a brokerage app for stocks, a hardware wallet for crypto, and a spreadsheet that was always out of date.

I couldn't find a tool that respected every asset class equally. Stock apps treated crypto as an afterthought; crypto apps ignored my ETFs.

So, I Built FinSxS

FinSxS (Financial Side-by-Side) was born from frustration. It is designed to be the single source of truth for the cross-asset investor.

Unlike mainstream trackers that silo your assets, FinSxS unifies them:

- Global Allocation at a Glance: See your true net worth split across Crypto, ETFs, and Equities in one pie chart. Spot overexposure instantly.

- Multi-Currency Normalization: Have EUR stocks, USD crypto, and GBP cash? We normalize everything to your base currency automatically using ECB rates.

- Relative Performance: Stop guessing if your diversification is working. Benchmark your entire portfolio against the S&P 500 or custom indices.

- Privacy-First: Your data is yours. We don't sell it, and we don't share it.

See Your Full Financial Picture

You don't need to use my 33/33/33 split to benefit from FinSxS. Whether you have a classic 60/40 portfolio or a complex mix of alts and equities, you need to see how they interact.

Stop juggling apps and broken spreadsheets. Try FinSxS. Free sign-up, no card needed. Explore the Global Portfolio Dashboard or start tracking.

Follow @Fin_SxS on X for tips. Feedback?